ADVANTAGES OF THE INVOICING MODULE

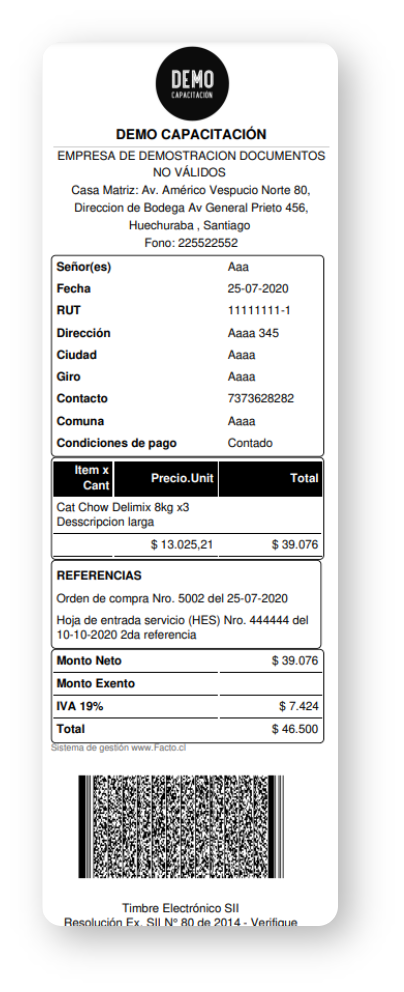

Row Billing allows you to issue invoices, tax-exempt invoices, and electronic credit notes without quantity or amount limits. Select payment terms, associated sellers, and billing details. Add products quickly directly from the warehouse or enter them manually. Assign specific taxes and discount terms, and use multiple print formats for letter paper or thermal printer.

Our invoicing module will allow you to keep your inventory always up to date since all the invoices you issue or receive will cause the merchandise to be deducted or added to your warehouse as appropriate

Free electronic invoices and tax-exempt invoices for your business? Yes indeed 😏 all our plans, including the free one, allow you to issue electronic invoices and exemptions without any cost or limitation. You just need to register and upload your certificate to start the enablement

Row Billing allows you to issue credit or debit notes completely free of charge for all your electronic invoices already sent to the SII. Upon completing this process, a credit note will be automatically issued with the data of the document you are modifying or canceling.

Row Billing adapts to your needs 😍

We have many formats and 3 models of letter-size invoices for you to choose the one you like the most. In addition, our 50mm and 80mm thermal formats are compatible with POS machines and thermal printers, allowing you to save ink and paper

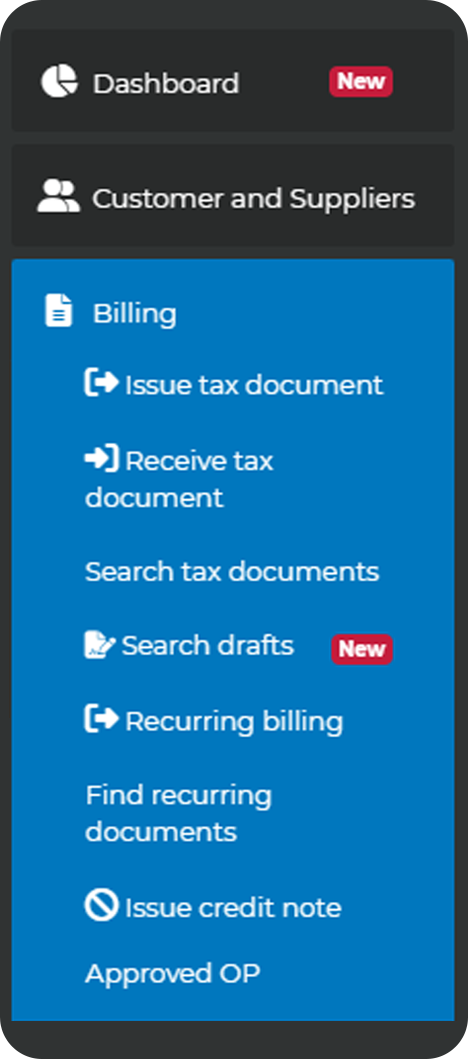

Search for DTE

In this option, you can search and consult all your electronic tax documents using basic or advanced filters

Credit and debit notes

This option allows you to modify or cancel invoices or receipts that have already been sent to the SII

Issue and receive DTE

In this first section, you will find the options to issue or enter tax documents such as electronic receipts or invoices

Quotations

Allows you to access the list of approved budgets or quotations to issue a receipt or invoice based on them